There are no two ways about it: saving money is not easy. Anybody who has ever had to save up to buy something (and let’s face it, that’s most of us) knows that putting money aside can take a long time and require more self-restraint than you’d think.

When asking around about the best way to save money, you’re likely to get a whole range of different answers from people who approach the subject in their own manner. Some will regularly put aside money into a dedicated account and others might have found ways that technology can help them to control their spending, but anybody who is saving will be able to tell you that it takes effort.

In this guide we look at some of the most effective ways of saving money, so keep reading to find out how you could start creating a nest egg of your own.

Why should you save money?

Saving money is one of the clearest routes towards financial stability – a goal that many people strive for. There are plenty of personal reasons which prompt people to start putting money aside, but there are some common themes too.

Financial security

The bottom line is that saving money can allow you to enjoy greater financial security. Putting money aside can create a level of financial stability that could support you through later life and is one of the reasons that saving for a pension is considered important.

A fallback for emergencies

Having money set aside for emergencies can allow you and your family to feel secure in the event that something unexpected happens. An emergency fund could help you to stay afloat when you’re faced with a sudden bill or expense, whether for a very serious matter or simply to repair your vehicle. When you’ve put money aside, you can deal with difficult situations safe in the knowledge that you’re equipped to weather the storm.

It prevents unnecessary borrowing

Another good reason to keep some money back is to ensure that you can afford to pay for the things you need without having to consistently borrow. Borrowing money is not always a bad thing, but it can become more of a concern if you find yourself unable to make payments or purchases without the help of a loan or other finance solution. By saving money, you can keep your borrowing to a reasonable level and prevent yourself from having to pay more back in interest in the long term.

You can enjoy more of what you love

If the security of having a fallback fund in case of emergency doesn’t entice you to start saving, being able to afford more of the things you love just might. Generating a pot of savings could help you to buy more gear for your hobbies, take a well-deserved holiday or visit more of the places on your bucket list.

How to decide whether to save or borrow

Saving and borrowing money are two sides of the same coin. There are many banks and other financial institutions offering products that fall on both sides of the divide and the right product for you will depend on your circumstances and priorities.

Money-Saving Products

Money-saving products are most typically offered by banks and building societies in the form of traditional savings accounts and ISAs (Individual Savings Accounts). These are accounts that allow you to put money aside in an easy way, and sometimes with the benefit of a preferential higher interest rate.

Borrowing Money

By contrast, borrowing products are those that give customers access to credit – money that can be used to make purchases provided that what is spent is paid back at a later date, often with added interest and fees. Products that fall into this category include loans, credit cards, store cards and hire purchase arrangements.

Choose between borrowing and saving money

Unfortunately, the choice between borrowing and saving money is rarely as simple as working out which product is most attractive to you at the time. When a bill needs paying, those who already have the money saved are more likely to opt to pay outright, whilst those who do not have the necessary financial resources to their name are more likely to borrow money to pay what they owe.

In cases where you do have a genuine choice between borrowing or saving money to pay for something, you may wish to weigh up your options by looking at all of the consequences of either choice. By spending the money you have saved, you may no longer be in a position to rely on your cash reserves if an unexpected cost arises in the future. On the other hand, borrowing money to pay for something could leave you paying more in the long run as interest and fees come into play.

Only by balancing the advantages and disadvantages of either approach can you find a financial solution that truly meets your needs and reflects your circumstances.

What are the best places to save money?

Choosing where to save money can be just as important as working out how much you can afford to put aside. There are many different types of savings accounts available in the UK, which means that there is plenty of scope to choose one that works for you.

Before approaching the topic of banks and building societies, it’s vital to point out why saving with a financial institution can be much safer than simply keeping your money at home. Under rules set out by the Financial Services Compensation Scheme (FSCS), the first £85,000 held in your account is protected in the event that your banking provider goes bust. In joint accounts, the first £170,000 is protected. This all means that using a financial services provider is a secure way of storing and saving your money. In contrast, if you kept all of your savings tucked under the mattress (as people may have done in years gone by) you will not usually be entitled to any compensation should the worst happen and you lose the money to a burglary, accident, flood or fire.

What’s the best savings account?

Different types of savings accounts and schemes have their own advantages, disadvantages and rules. Choosing the right one for you will very much depend on your situation, goals and ability to meet those rules – so it’s worth shopping around to find the right account for you. Doing this will not only make it easier for you to maximise your savings but it could also encourage you to put more aside.

Some of the most popular options amongst UK savers are:

Lifetime ISAs

First launched in April 2017, a Lifetime ISA (LISA) is only available to first-time buyers aged between 18 to 39. LISAs allow eligible savers to pay up to £4,000 per tax year into their account either as a lump sum or by paying in smaller but more regular amounts. On top of what you can manage to save, the government add a 25% bonus on top, so by saving £4,000 you will actually benefit from a pot of £5,000.

Money saved in a LISA can be used by first-time buyers to fund all or part of the deposit for their first home costing up to £450,000, once they have held the account for 12 months. Savings held in a Lifetime ISA can also be used for later-life savings, but anybody considering this route may wish to first decide whether putting money towards a pension could be more advantageous.

Bank Accounts

Saving in an ordinary bank current account could be more beneficial than you might think. Many banks use their current accounts as a way of attracting customers towards some of their more sophisticated products, and so if you can find an account that has a relatively high-interest rate it might be worthwhile to take advantage of the opportunity to maximise your savings.

Regular Savings Accounts

Lots of banks offer regular savings accounts, which generally pay a high rate of interest but limit the amount of money you can pay in. If you are already holding a considerable amount of money in your current account, you might decide to begin drip-feeding a small amount into a savings account on a regular basis.

Saving in this way could also help you to stop spending money on things you don’t need, as it won’t always be as readily available as the funds held in your current account.

Fixed-Rate & Cash ISAs

Much like a savings account, a cash ISA is simply an account in which any interest earned is not taxed – which means all of it goes back into your savings pot. Anybody aged over 16 can open an ISA in the UK, and you can then pay in up to £20,000 per tax year (running from 6 April to 5 April the following year).

It is worth keeping in mind the rules associated with any ISA account you open. In certain cases, you will not be able to access the money immediately if you need it and if you do make a withdrawal during the ISA term you may lose some interest to penalty fees. Once an ISA has matured, withdrawing the money will not incur any penalties and so sometimes patience really does pay off.

Fixed Rate Savings

UK savers may also find that a fixed-rate savings account suits their needs. These are much more restrictive accounts that effectively lock away some of your money for a set period of time but at a higher rate of interest.

With a fixed-rate savings account, you will generally earn more money in interest than with any of the other accounts we have mentioned so far – but it comes with a catch. These accounts typically have long fixed term and you may not be able to access your money for several years without paying a substantial penalty. Thinking long term could pay dividends, but it won’t suit everyone.

How do interest rates work?

Interest rates can have a huge influence on how financial products work. When you’re borrowing money, for instance as a loan, the interest rate determines how much you will pay back in addition to any fees. In the case of savings, interest rates affect how much money you earn for keeping your funds with a given provider.

The interest rate can be used to calculate how much your bank or building society will pay you for keeping your money with them. This is because financial providers often use the money of their customers to make investments, whilst ensuring that the funds remain available at all times. This rate is usually expressed as an Annual Equivalent Rate (AER), whereas interest charged on borrowing is usually shown as an Annual Percentage Rate (APR). The AER rate shows what you would earn in interest if you put money into the account and left it there, but it is also possible to express the interest earned as a gross rate. The gross rate indicates the annual rate of interest to be paid out before taxes or other charges are deducted.

To give a simple example of how interest on savings works, if you were to place £100 in an account with a 2% annual rate of interest, you would earn £2 over the course of a year leaving you with £102. The amount of interest earned will depend on the amount of money kept in the relevant account, along with the rate set by the bank or building society.

How are interest rates set?

Interest rates are set by the individual banks and building societies that operate across the UK. They determine how much they charge for borrowing, and how much they will pay you to keep your money with them – but their rates are usually influenced by the base rate that is set by the Bank of England.

When the Bank of England base rate rises, banks are likely to reflect this by raising their own rates and paying savers more for their custom. Similarly, if the rate falls, the amount you earn in interest could also drop.

What’s compound interest?

Compound interest applies where you have already earned interest on your savings and so the new amount to be calculated must take into account how much has accrued. To use the same example as earlier, if you put £100 in a savings account with a 2% interest rate, you would be left with £102 after a year. With compound interest, your pot will keep growing as you continue to save – as shown in the table below:

| Savings Term | Savings | Interest Earned | 2% Interest |

| 1 Year | £100 | £2 | £102 |

| 2 Years | £102 | £2.04 | £104.04 |

| 3 Years | £104.04 | £2.08 | £106.12 |

| 4 Years | £106.12 | £2.12 | £108.24 |

| 5 Years | £108.24 | £2.16 | £110.40 |

Do you get taxed on interest?

In most cases, if you are a UK taxpayer the money you earn on your savings will be subject to tax. The main exception to this rule is if you have kept your savings in a cash ISA, whereby you will be able to keep any interest payments you receive tax-free.

As of April 2016, the government also introduced a new personal savings allowance, which means that the majority of UK adults who pay basic rate tax are entitled to earn up to £1,000 in interest without having to pay tax on that sum. For higher rate taxpayers, the interest-free allowance is £500.

How does inflation affect savings?

Inflation is an economic trend in which average prices go up across an entire country. This means that the buying power of an individual pound is reduced as the price of goods, services and generally everything else has increased. A simple example is if you were to go and buy a loaf of bread today for £1, with the current inflation rate at 2%. If you were to buy the same bread next year with prices adjusted for inflation, you would pay £1.20.

Inflation is the reason that houses and other major purchases cost more across the board today. As time passes, wages and prices rise to push the price level of goods and services up and the value of currency goes down. In May 2020, the UK’s Office for National Statistics estimated that the inflation rate was around 0.7% – but this rate fluctuates from month to month.

As time goes on, the effect of inflation can reduce the value of your savings as prices continue to rise. This is most obvious with cash, and if you were to keep £10,000 at home, the money would likely not be worth as much in the future. Although you would still have the same amount of cash, it would be less valuable and would be unlikely to go as far – all because of inflation.

Although money kept in the bank is not immune from the effects of inflation, any interest that you earn against your savings could help to balance out the loss of value. When the rate of inflation is high, banks often pay higher interest rates to combat this – although you may still lose some value.

Choose between saving and investing

Before you go out and open a new savings account, you may also wish to consider whether investing your money could be a more appropriate way forward for you. Whereas saving involves putting your money aside, investing involves putting your money to work. This is done by purchasing things you think will grow in value or buying shares or stocks that you believe will pay off as the recipient of your funds begins to make money, for example.

A major consideration for anybody who has thought about investing is that it can be much riskier than simply saving the money, and you could even lose the value of what you put in. Investing is not necessarily a short term strategy either, and so it may not be the answer you’re looking for if your goal is simply to raise some extra money for an upcoming holiday or occasion.

Those are not experienced with making investments may also find it beneficial to seek financial advice before they put their money towards anything – as this could help you to gain an understanding of the risks and potential benefits of each available option.

How to save money for a car

Alongside houses, a car can be one of the most expensive things you will ever buy. Whether you purchase your vehicle outright or borrow the money, getting a new car often requires a significant initial outlay which many people find they must save up for.

Why save money for a car

For those who intend to buy their car outright, the need to save up is fairly obvious. Buying in this way prevents you from having to make ongoing payments to a dealership or another seller, but it isn’t an achievable goal for everybody. For many people a finance product, hire purchase agreement or even vehicle leasing will be more realistic.

For those who opt for any of the finance products available, it will almost certainly by the case that putting down a larger deposit will reduce the overall cost of buying the vehicle. This is because, except in the case of 0% finance offers, the more money that is taken out as a loan or hire purchase, the more interest and fees that could be applied over the repayment term.

How to save up enough for a car

Saving up enough money to buy a car could take some time, and one of the first steps on that journey is deciding how much you can afford to put aside on a regular basis. The sooner you begin, the more money you are likely to have to contribute as a deposit and so waiting to start saving won’t help.

The amount you need to save will depend on the cost of the vehicle you want to buy, and this is where it’s important to be realistic. If you set your monthly or weekly savings target too high, you are less likely to see your goal through to its conclusion. Setting an affordable goal could make buying a car much more achievable, as you won’t be stretching your finances to reach your target.

For those who really struggle to put money aside, choosing the right kind of savings account could prevent any unplanned withdrawals and maximise the amount you have to put towards purchasing a vehicle. A fixed-term savings account could prevent you from accessing the money before a certain date, ensuring that you do not dip into your car fund for other kinds of spending. Another option might be a cash ISA, which could grant you a higher interest rate than a usual bank account – generating some additional funds on top of those you manage to save yourself.

Accounting for the extras

Regardless of the model or make of your dream car, when saving up it’s worth remembering that the costs don’t end when you leave the forecourt. Insurance, maintenance, road tax and fuel are all factors that must be considered when choosing a vehicle to purchase. Buying a car is one thing, but if you can’t afford to keep it road legal then your money may have gone to waste.

Before you part with your savings, you could find it useful to scope out any additional costs that need to be considered. Getting an insurance quote from a comparison website is now easier than ever, whilst you can check the vehicle tax rate applicable to your vehicle on the government’s website.

How to save for a holiday

Everybody deserves a holiday now and then, but taking some time to unwind isn’t always cheap and travelling comes with its own costs. Whether you are planning a holiday in the UK or abroad, it is often preferable to save money rather than borrow it, as doing so could leave you paying for your break for months to come.

The key to saving for a holiday is setting a realistic budget and sticking to it. For many savers, one of the easiest ways to kick things off is to make a budget plan which takes into account all of your income and outgoings to help you decide how much you can reasonably afford to set aside on a regular basis. With this information, you can also start to look at holidays that are affordable for you, considering not only the cost of travel and accommodation but also spending money and the cost of activities whilst you’re on your break.

One of the biggest obstacles faced when saving for a holiday is overcommitting to your trip fund. If you try too hard you could end up cutting into money you need for other things and simply giving up. If you really struggle with saving, putting any amount of money away is better than nothing and just keeping spare change in a jar is a respectable start.

Putting just £2.50 away every day would leave you with just over £1,000 in a year, so it’s easy to see how saving little and often stacks up. Just remember that, as your savings pot grows, you could be generating some interest on top if you keep the money in a bank account so stashing it away in a jar isn’t always the best policy.

How to save for Christmas

The festive season is amongst the most expensive occasions of the year, with the average person estimated to spend somewhere in the region of two weeks’ take-home pay each Christmas. With such high levels of spending, Christmas is also a time when many people find that they must turn to credit cards and finance agreements to fund their purchases – which could leave them struggling to get back on their feet during the coming year.

By saving up money and keeping to a well-planned budget, you could find yourself much more comfortable at Christmas-time and beyond.

Set spending goals

Christmas is a prime time for overspending, and some people find it helps to get their financial goals and expectations in place well beforehand. Your receipts from last Christmas could provide a good starting point and let you pick out any areas where you overspent. Whether you find ways to cut back on food, presents or travel, being realistic about what you can afford could make the holiday period all the more enjoyable as you won’t be as stressed about getting into debt.

Once you’ve worked out a rough budget for Christmas, you can start to save towards that goal. With clear limits set on the costs of gifts, food and other items, measuring your progress couldn’t be easier as you will be able to recognise when you reach enough money to buy certain things. Extending these spending guidelines to your everyday life could also help you on your way to a Merry Christmas, with any surplus left over from your income after essential expenses becoming available to spend on the holidays.

Shop early

Although not strictly saving up for Christmas, why stow away your money when you could simply spend less. It’s widely known that the best deals on gifts of all kinds are not found around the holiday season and keeping an eye out for bargains during the year could pay dividends when December comes around.

Whether you buy your Christmas gifts during the August/September back to school sales, on Black Friday or as retailers stage their own promotions throughout the year, buying early could not only make your life easier but your Christmas spend cheaper.

Be wary of Christmas savings clubs

A Christmas savings club might seem like a great way to put money aside for a great festive period, but it’s vital for anybody considering this to do their research. Whilst there are a good number of undoubtedly legitimate savings schemes, there are some unofficial clubs that leave savers risking their Christmas fund.

Widely reported by the media, some former Christmas savings club members have been left without a penny of the money they put aside – having entrusted it to the care of a scheme without any controls or protections. The clubs involved are often focussed on a particular community, whether that be a village pub, family centre or church. In any case, with no checks or balances in place to keep the savings being used up by those managing the money, it might be easier than you think to lose what you have been working towards.

As with most other financial products and initiatives, it usually makes sense to take advice and only use the services of a reputable provider.

How much should you have in emergency savings in the UK?

When it comes to having a rainy day fund, it’s generally true that the more money you have saved up, the better. Many financial advisers and official bodies recommend working towards an emergency savings pot of at least three months’ salary. These funds could then act as a financial buffer if you lose your income or have to deal with an unexpected expense.

As an emergency fund is intended to help deal with unexpected situations, it’s important to make sure that your funds are kept in an accessible account that doesn’t require notice for you to access your money. There are lots of different accounts available that could fit the bill, but some of the features you might wish to look for include the ability to pay in additional funds whenever you want and the availability of online banking services to help you manage your account easily.

Even though an unexpected bill could crop up at any time, it’s important to think reasonably and not expect yourself to save up months’ worth of pay in a short period of time. It could take a number of months or even years for you to reach a savings figure that you’re comfortable with. The key to saving is commitment coupled with consistency. Working towards your goals whilst consistently making deposits into your savings account will eventually see you hit your target and perhaps even surpass it.

The best apps to help you save money

Understanding what you need to do to save money can be easy, but getting the basics right is often much more difficult. Fortunately, there are plenty of tools out there to help savers on their way including apps which suit salary stashers and bargain hunters alike.

Benefitting from open banking principles, some of the apps available could even analyse the transactions in your account to provide suggestions for better money management. Below are some of our top suggestions for money-saving apps to download:

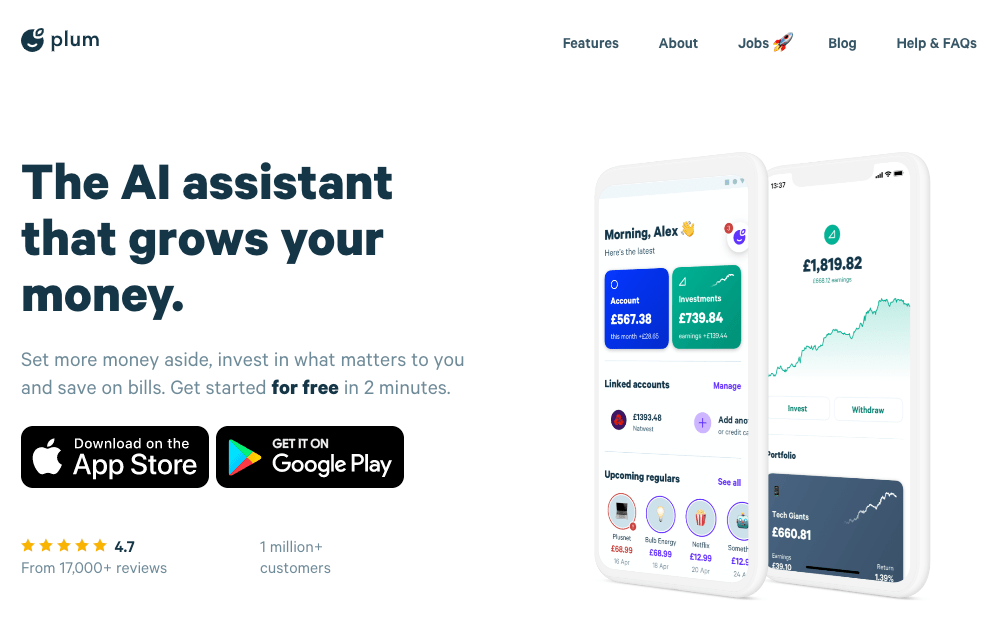

Plum

With the option to start using a fully equipped savings tool via either a standalone app or Facebook Messenger, Plum uses an algorithm to determine how much you can afford to save. Factoring in your spending habits and income, Plum also gives you the option to enable automatic movements – which quickly transfer any savings into a standalone account making sure that you take every opportunity to stock up your stash.

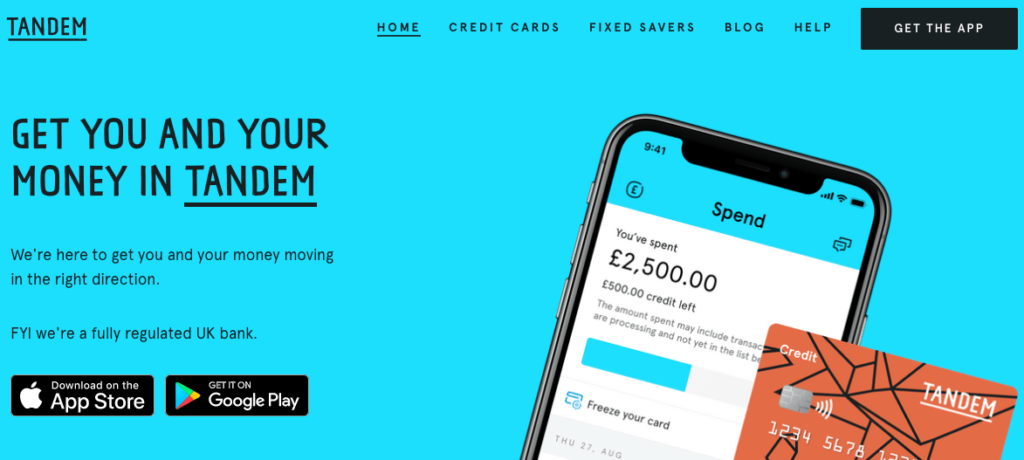

Tandem

Available on both Apple iPhone and Android mobile devices, Tandem is an online banking tool that links with your main account to apply saving rules to your spending. Giving you the option of regular deposits, or algorithm-driven saving, Tandem also lets savers decide to round up their purchases to the nearest pound – saving the difference in a standalone pot. This means that you’ll be saving 80p for all of those £3.20 coffees you buy.

Tandem has also acquired its own banking license, meaning that your savings are protected under the FSCS rules up to the value of £85,000.

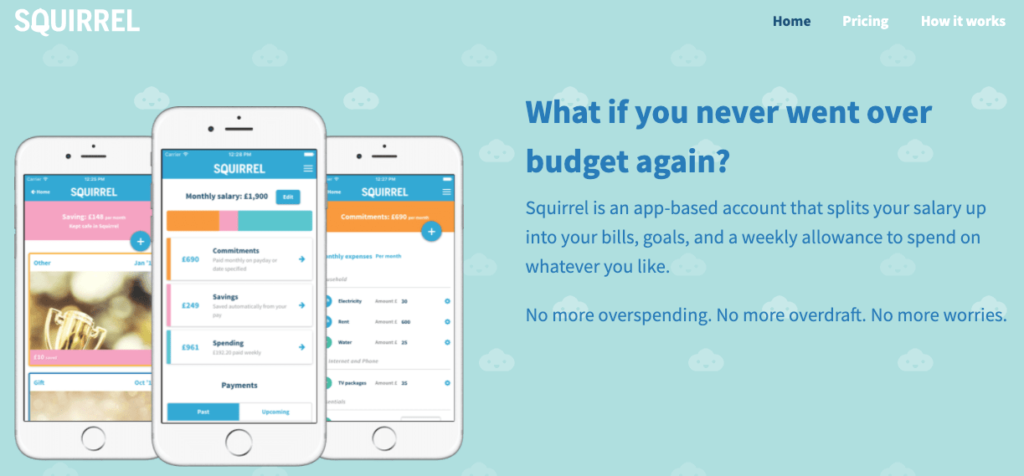

Squirrel

As an app-based bank account, Squirrel splits your income up into bills and goals whilst providing you with a weekly allowance figure to spend on whatever you want. For savers who really struggle to stick to their goals, this guided approach could help to provide a little more structure which could help to focus your saving efforts.

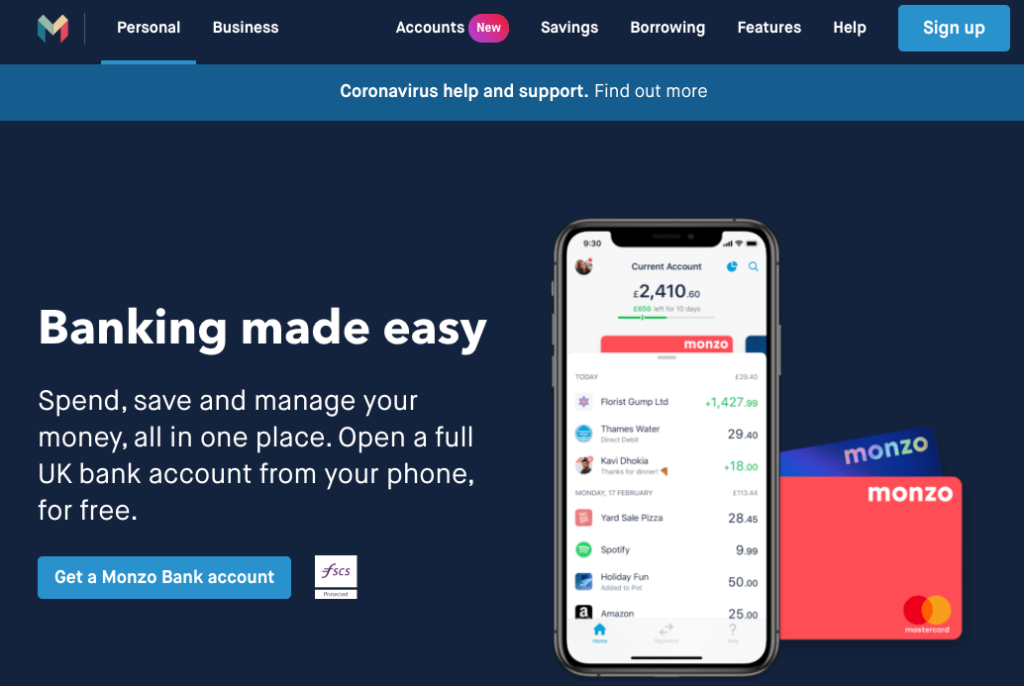

Monzo

Another of the many popular online banks that have cropped up in recent years, Monzo has become something of a household name. Aside from providing more regular banking facilities, Monzo gives users real-time notifications when they spend on their debit cards, whilst also generating insights and statistics from the outgoings. This could arm you with the information you need to start making more sensible financial decisions, whilst also providing options for features like rounding up spends to the nearest pound and saving the difference.

Whilst Monzo does not operate from any physical branches, they also do not impose fees for spending on your card whilst abroad. This means that Monzo could be the perfect solution for saving money on fees whilst travelling or on holiday.

Top money-saving tips

We all know that saving money can be difficult, but there are some things you can do that could make putting cash aside that much easier. What works for one person might not be appropriate for another, and the most important factor when trying to effectively save money is finding what works for you. That being said, here are some of the more common top tips for saving money:

Don’t go all out on payday

It seems simple, but you might be surprised by how many people overspend on the day they get paid. According to a survey conducted by Nationwide Building Society, 1 in 5 people end up splurging over half of their spare income within just a few days of getting paid. Doing this could leave you struggling for the rest of the month and dipping into any savings you do have for any extra costs. Being a little more restrained could see you keeping more back each month and not constantly eating into your existing savings.

Make saving a regular thing

Saving money seems easy when you’re setting out, and if we all stuck to our best intentions we’d have plenty in the bank. The problem is that life gets in the way and deciding not to save as much one month could easily lead to you scrapping your targets altogether. By setting up a standing order from your main bank account into a savings account, you could make saving a regular, automatic process which takes little effort on your part and stops you from having to make money transfer decisions.

Take advantage of your workplace benefits

It seems simple, and may not apply to everyone, but those who haven’t checked out the benefits offered by their employer may wish to do so. Ranging from discounts on transport and buying a bike, through to healthcare plans and local restaurant discounts, you could save money from your usual outgoings just by using the discounts curated by your company. In many cases, these are managed by the HR team, so what do you have to lose by reaching out and asking what’s available?

Keep an eye on your spending

Knowing what you spend your money on is an important part of saving, and going through your bank transactions could uncover regular spends that you no longer need. An unused gym membership or old magazine subscription could see you paying more than you need to towards something you don’t even benefit from – so work out what you need and clear house to ensure that you’re maximising the amount you can save.

The bottom line

There are times when we could all do with some extra cash to keep things ticking over, or to deal with life’s little emergencies. Having a well-stocked savings pot could be the answer to living life with a little bit more freely, as it might leave you more confident in your ability to deal with whatever happens.

How you approach saving money will depend on lots of things, from your income and expenditure to your preference of banking provider. No matter how you go about putting money aside, though, we hope that this guide has given you a bit more insight into the world of saving.

You can also check out our guide on managing couple finances and many more at CreditAction.co.uk!