Taking control of your financial situation can sometimes be a difficult step to take, but one that can pay dividends and make life easier in many ways. With a more stable financial outlook, you’ll be better equipped to reach whatever goals you may have whilst dealing with any unexpected emergencies along the way.

Before you can really get a handle on your finances, though, you need to know what you’re working with and what you’re working towards. Planning a budget is one of the most effective ways to gain real insight into your own circumstances, and you could start to improve your outlook by putting in place a framework for spending.

Keep reading our dedicated guide to budget planning to find out how you could start to develop a way forward that works for you, whilst benefiting from a more structured approach to spending.

What is budgeting?

Budgeting can take many forms, but ultimately it boils down to two major points – working out what your financial position is and calculating how much you can afford to spend whilst sticking to your saving plans.

Does your spending outweigh what you earn?

Spending more than you earn can leave you dipping into your savings and even getting into debt. If this sounds like you, it could be the case that you’re overspending. To address this issue, you need to have a complete and accurate understanding of your own financial circumstances.

A budget plan could help you to gain insight into your spending by setting out how much you earn, alongside how much money is leaving your account each month. On top of this, a properly kept budget plan will keep a detailed record of your expenditure so you can pinpoint any areas where you’re spending too much.

How much can you reasonably afford to spend?

The next stage of budgeting is working out what you can afford to spend whilst working towards your financial goals. These could be something like saving up for a mortgage deposit or a big purchase, but it could be as simple as just wanting to live within your means and stop spending more than you earn.

A budget plan could also help you to prioritise your saving and spending, to ensure that you can still afford the things you love whilst also making sure that you’re keeping enough aside to pay for any essential costs.

Why should you budget your money?

There are lots of good reasons for budgeting your money, and it’s often the case that people are more likely to stick to a budget if they’re motivated by their own challenges and goals. One of the main benefits of budgeting is that it helps you stay on track by ensuring that you have enough money to pay for the things that you need. Aside from this, it could also be beneficial if you are:

Budgeting to pay off debt

Debt is often one of the biggest obstacles for people looking to achieve financial security, yet dealing with it can be straightforward. You needn’t eliminate your debt entirely or even take a totally anti-debt approach to your spending – but many people will find life more comfortable if they reduce their debt figure to manageable levels.

Budgeting is a vital element of managing your debt as not only can it help you to save up enough money to pay off what you owe, but it could also allow you to manage your liabilities and even avoid certain forms of debt in the first place.

Budgeting to buy a car

Setting a budget to work towards a car deposit is one thing, but having a financial framework in place could help make the whole experience of owning a vehicle much easier. For one thing, it could give you a better understanding to the true cost of a car, as the ticket price alone will not show the ongoing cost of fuel, maintenance, tax, or insurance.

For some savers, budgeting could even help you to put away enough money to purchase a vehicle outright or at the very least put down a bigger deposit at the start of a finance agreement.

Budgeting to buy a house

If you’re tired of renting and looking to get onto the housing ladder, you’ll need to think about raising the money for a deposit before you’ll be approved for a mortgage. Lenders ask for varying amounts of money to act as a deposit, but the figure often falls somewhere between 5% and 15%. It goes without saying that with the cost of property in the UK this can run into the thousands and tens of thousands – so budgeting and saving is often a must.

Creating and sticking to a realistic budget before you buy a house also serves as good practice for when you are a homeowner. There are many ongoing and regular costs associated with running your own home and so getting your financial situation in order beforehand could prove to be very helpful.

Budgeting to save for retirement

As you enter later life, money will often remain amongst your central focuses as you start to spend more time doing what you enjoy whilst forgoing the regular income that employment brings. That isn’t to say that retirees don’t have an income, as most will rely on some form of pension along with their savings, but this often represents a drop to the amount coming in each month.

Budgeting for retirement is something that could not only leave you with a larger pot of savings to fall back on as you grow older, but could also help you to develop the responsible behaviours that will keep your bank balance at a healthy level for years to come.

How to make a budget

No matter what it is you’re working towards, the process of making a budget is much the same. Even if you don’t plan on using a budget tracking spreadsheet on an ongoing basis, you will most likely need to work out your income and expenditure in a detailed way. Ultimately, how you do this will depend on which method you find works best for you – but this could take any form from a detailed spreadsheet with automatic calculations through to a simple back of a page tally showing your earning versus spending.

Regardless of which approach you choose, your budget will most likely involve the following steps:

Stage 1 – Start recording your income

The first port of call for any budget plan is to work out how much money you have coming in. This is the figure that will ultimately determine how much you can afford to pay out for extras once you have accounted for any essential bills and contributed to your savings.

One of the reasons it’s so useful to record your income is that doing so can stop you from overspending. In most cases, when your employer tells you how much your salary is worth, they will provide what is known as a gross figure – this is how much you earn before any money is deducted for tax, student loan or pension contributions.

If you made your budget based on this figure, you could end up overspending as your calculations will be based on a higher income than you actually have. Instead, a more realistic budget will account for what is known as your net income or take-home pay. This is the figure that actually hits your bank account after taxes and other costs have been deducted and is the amount that you’ll have to work with.

Stage 2 – Track what you spend

The other side of earning is spending, and a budget cannot work without taking both into account. Tracking your spending habits could prove to be an interesting exercise – revealing just how much you spend on those daily coffees or whether the cost of your utility bills has crept too high.

You could make a start by listing off all of your fixed costs. Monthly bills, rent or mortgage payments, utilities and any direct debits for insurance premiums are the baseline of your spending and are the costs that you are less likely to be able to cut.

Moving onto your variable expenses, you’ll begin to see the areas that you could cut down or switch providers to save money. These are costs that are likely to change from month to month and might include groceries, clothing and entertainment. The important thing is that you track all of your spending – otherwise you could find that money from your budget is simply going missing. Whether you use an app, spending calculator or good old fashioned pen and paper, keeping tabs on your spending habits is an essential aspect of making an effective budget.

Stage 3 – Set goals

Once you’ve collected together all the information about your income and spending, its time to set your goals and work out what you what want to accomplish going forward. Budgeters might find it helpful to set both short and long term goals, as some will be easier to reach than others and having an incentive to keep going could stop you from straying into reckless spending.

Short-term goals, which could take anywhere between a month to a year to reach, might include paying off a small personal loan or just saving a certain amount on a regular basis. Long-term goals are often much loftier and might involve putting money away for retirement or into a savings fund for your children.

Regardless of the goals that you set, remember that they don’t have to be permanent and can change with your circumstances as necessary. Just having them in place can encourage you to stick to your budget and you might find it easier to stay on track if you have a clear and achievable target to work towards.

Stage 4 – Planning your budget

So you know how much money you have coming in, how much is regularly going out and a target that you’re working towards. The next logical step of budgeting is to work out how you can manage your income and expenditure to reach your goals.

Much of this stage will come down to making changes to your fixed and variable expenses, trying to save money where possible and deciding if there is anything you can cut out completely. One way to achieve a successful outcome when planning a budget is to divide up your spending into various categories (think transport, groceries, entertainment etc) and allocate yourself a spending limit. Provided that you are realistic about this figure, you might find that your new approach to managing money cuts out unnecessary costs and makes you more disciplined with your spending.

Stage 5 – Assess and adjust

With a simple formula of income, expenditure and targeted actions to reach your goals, budgeting might seem straightforward. By working out what you spend and where you could start to evaluate your spending habits and cut back where possible to leave more money for your targets.

No matter how ‘on-track’ your budget seems, however, it can be important to continue monitoring your spending and assessing how it translates into the real world. It isn’t the case that you should have to forego essential items and if you find yourself struggling to stick to your spending targets you might find it helpful to adjust your plan. Circumstances change and that means that the most successful budgets are flexible ones.

How to track your budget

A budget can only truly work if you find a way to effectively track your spending. It’s easy enough to work out how much money you have coming in – as this will be recorded in your payslip or in an easily identifiable way on your bank statements – but it doesn’t take much to lose track of your spending.

This is because it’s important not just to know how much you’ve spent, but where you’ve spent it. You can only start to cut out unnecessary expenses when you have full accountability for your spending habits – and that means keeping tabs on where you part with your hard-earned cash.

The best way to track your spending will be the one that works for you and slots into your lifestyle, and just some of the options include:

Reviewing your account statements

One way to track your spending is to follow the money on your account statements or online banking app. Provided that you primarily spend on card, this will give a fairly accurate account of everywhere that you’ve spent money in the recent past and can help you to work out where that big balance hit came from.

Bank statements are some of the most useful parts of a budgeter’s toolkit, but they do have some drawbacks that should be kept in mind. Firstly, if you spend in cash you will only be able to track the amount of money you took out – not where you spent it. Similarly, not all companies use the name they trade under for banking purposes, and this could lead to confusion when trying to work out what your £50 spend with “Corporate Retailers Ltd” was when you can only remember spending in a high street shop.

Labelling your expenses

Grouping your expenses together could help you to identify the trends and patterns in your spending that will eventually lead to change. Some banks and credit card providers already divide spending into clear categories such as food or spending for vehicles, but if yours doesn’t you could always take a highlighter to your bank statements.

Calculating what you spend in each area might help you to work out where the weak points of your budget are and account for them accordingly. Whether it’s too many trips to the coffee shop or recurring subscriptions for entertainment that you don’t use any more, categorising your spending is a helpful way of showing you how your money gets used up.

Using a budgeting app

If you struggle to keep a record of what you’re spending, there’s no need to worry as other solutions are available. Nowadays technology reaches into every area of banking and could even help you to track your money from your phone.

With apps that could connect directly to your bank account, your spending could be divided up into categories automatically and even be tracked across accounts.

Using Pre-Made Budgeting Spreadsheet Template:

Here are some of the best templates we found:

- Foundation Template

- Household Budget Template

- Complete budget and receipt tracker

- Weekly Budget Worksheet

- Google’s own Monthly Budget template

Being realistic about your budget

Anyone who’s already tried their hand at budgeting will know that it doesn’t always go to plan. Personal finance gurus and self-help books might make it seem as easy as just creating a budget and sticking to it, but the reality is that it’s just not that simple.

In many cases, the reason for this is because we underestimate how much we spend on a regular basis. It’s obvious enough to record your most basic spending habits for things like accommodation, transport, household utilities and food, but not everything falls so easily into place and it’s the less regular payments that can break a budget. These could include payments for vehicle maintenance, home improvements and holiday costs. This is because when most people set out to create a budget, they look at what they earn and devise a spending plan that works on the basis of regular payments without taking account of any unforeseen extras.

To get around this, budgeters might find it useful to set a goal to save up for an ‘emergency fund’. By keeping some money separate from your day to day spending account, you could begin to build a rainy day fund that can then be put towards any unexpected costs as they arise. With money put aside for car repairs, home maintenance and other emergency costs, you’ll be less likely to find yourself straying from your budget just to cover the essentials.

What to do if you overspend on your budget

Overspending is easy to do, but it can also be the downfall of an otherwise successful budget plan. Making a big purchase or a consistent pattern of spending can leave you struggling to catch up with your savings target or even leave you in debt, but there are things you can do to limit the impact of an overspend.

Accept your overspend

When you’ve spent outside of your budget it can be all too easy to write it off as a one-time thing, but if you don’t take stock of the situation you could end up overspending again and again. Accepting that you’ve overspent and factoring that into your budget for the remainder of the month could help you to limit the effect on your finances – especially if you still have money left over in your budget to spend at your discretion. Very few people will stick to the letter of their budget 100% of the time and so an occasional overspend need not be a cause for concern.

Identify the source

Once you’ve accepted the fact that you’ve overspent, finding out where your money went is the next step. This might prove simple if you’ve just made a large purchase, but more often than not an overspend will be the result of a number of many smaller purchases. If this is the case, making sure you accurately record your spending in a budget tracker or against your plan could help you to avoid shelling out so much in the future.

If you feel that your spending habits are out of your control or that you simply can’t manage with your budget, it may be time to seek help. This doesn’t necessarily mean that you need to approach a financial advisor (although that could certainly help) but instead you might find it useful to discuss your finances with a close friend or relative – who can help to keep you accountable for your spending.

Plan your next steps

When you know what caused you to overspend, you can start to plan for the future and take the positive steps to prevent it from happening again. Simply deciding to be “more responsible with your money” won’t always cut it, and you may find you have a better chance of sticking to your plan if you have a concrete strategy in place.

Whether this means realigning your goals to save up and settle debts you ran up from overspending or just cutting out some of the extra items you’ve been buying from your regular shopping, only you can make the changes that will benefit your bank balance. Budgeting is as much an art as it is a science and for most people this means that you won’t get it right all of the time. Only by assessing, amending and learning from your mistakes, could you reach a more stable financial position.

What are the best budgeting apps in the UK?

With open banking now making it possible to link your bank accounts to handy tools and apps, budgeting could be easier than ever before. There are lots of providers out there trying to make it easier to budget and reach your financial goals, and their services each have unique qualities which could make them the right tool for you.

To introduce you to some of the UK’s most popular budgeting apps, here are just a few of those available:

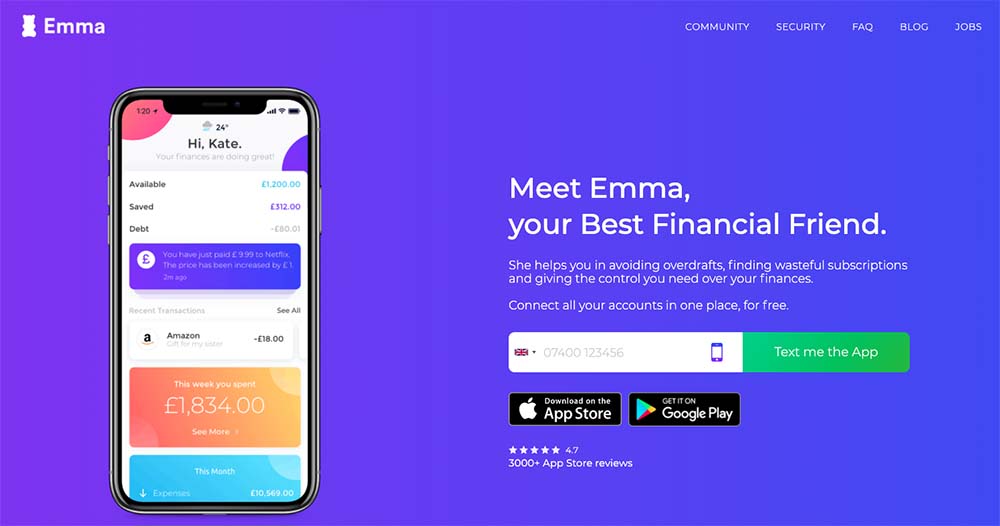

Emma

A helpful account tracker, Emma works by grouping all of your accounts together in one place before analysing your spending habits and giving you monthly saving tips. One of the most useful features of this innovative service is the subscription tracker, which could help you clear out any old subscription costs and free up some room in your budget.

Money Dashboard

Voted Best Personal Finance App in 2017 and 2018, Money Dashboard provides a clear and easy to use tracker which automatically categorises spending whilst helping you to predict your future finances. No matter how many accounts you have, Money Dashboard can display all of your transactions in a single place giving you ultimate visibility over your finances.

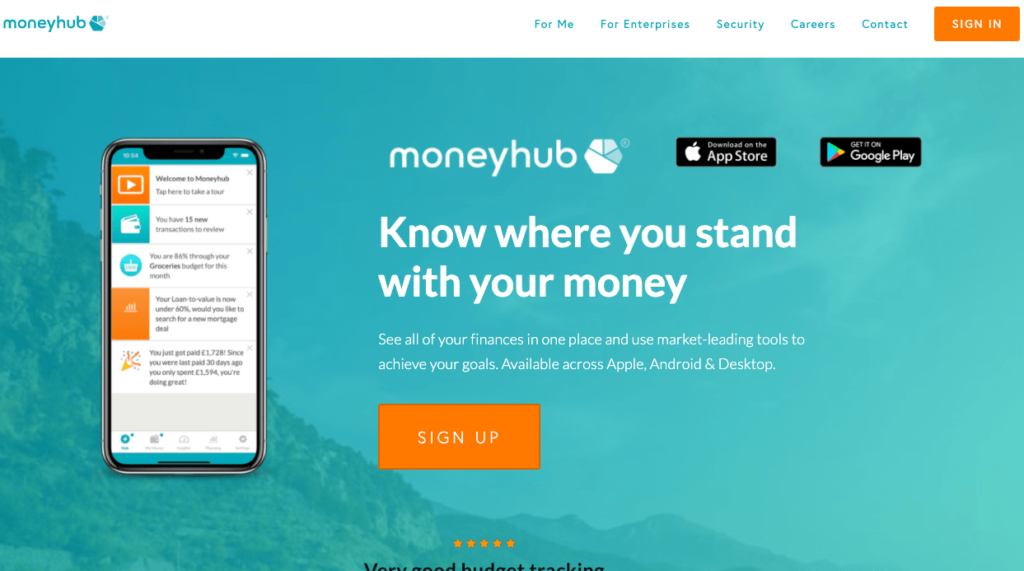

Moneyhub

Despite requiring a 99p monthly subscription, Moneyhub could give you peace of mind when accessing your financial data through their app. Giving regular insights into your spending habits, Moneyhub prides itself on its privacy-driven approach to open banking so you needn’t worry about the security of your sensitive financial data.

How to budget when you’re broke?

If your essential costs outstrip your regular income, the chances are that there won’t be much money left to spend or save once you’ve covered off your bills. In these situations, you may feel that your efforts aren’t getting you anywhere and it can be tempting to just abandon your budget.

If you find yourself in this position, you shouldn’t necessarily give up hope at the first hurdle. One of the first steps to making a success of a low-income budget is making certain that your goals are realistic. If you set your savings target too high or allocate yourself too little to cover the cost of groceries, you’re more likely to spend more than your budget allows and could find yourself falling off the wagon altogether.

Once you’ve made your peace with your financial circumstances, you can then start to work on improving them. Often people are told that they can make a start by finding a higher paying job, but this isn’t always achievable, and it certainly isn’t the only budgeting tool at your disposal. Budgeting is as much about how you spend as it is about what you earn. If you’re broke or not earning much at all, working on your spending habits is even more important as you’ll need to be careful to ensure that your bills don’t outstrip your income.

Of course it can’t hurt to find new ways to earn more money, but you may find it useful to take more targeted action in the meantime. Cutting down on your grocery bills by shopping at a different supermarket, looking around for cheaper providers of household utilities or trading in your vehicle for a model that is cheaper to run and insure are all examples of the ways that cash-strapped savers could make their budget work.

Ultimately, no one budgeting method will work for every situation and most people will only make a success of their efforts if they tailor them to their own circumstances.

How to budget when you’re unemployed

If you’re unemployed, the already difficult task of budgeting can be even harder. Managing your finances without a regular income is tough, and even if you have state support in the form of benefits, you might find it difficult to tread the line between what’s coming in and what you’re spending.

When you don’t have the security of a regular paycheque, making sure that you have enough money in reserve to pay for any unexpected costs can be even more important. This is because, if you don’t have a pot of savings allocated towards dealing with emergency situations, you could find yourself dipping into your overdraft or getting into other kinds of debt just to keep your head above the water.

If you find yourself with the income field of your budget plan looking depressingly empty, there are some things you can do to help improve your financial situation – and they don’t just include finding a job!

- Cut back on non-essentials – As much as we all love our holidays, day trips, and little luxuries, it isn’t always sensible to spend out when you’re struggling financially. If you are unemployed, there’s little you can do to influence the income side of your budget (aside from getting a job) and so you’re limited to changing the way you spend. You could make a start by separating your wants from your needs – those costs that are essential and those that are a nice bonus. It doesn’t mean you have to totally commit to not spending on the latter, but it could help you to cut down and realise exactly where your money has been going.

- Make sensible swaps – even if you are unemployed, you won’t necessarily have to give up the things you love just to keep your budget on track. By swapping out some of your regular high-cost spends, you could still enjoy life without the price tag. Making your own coffee rather than going to your favourite chain, eating in more or catching the bus rather than driving could all help you to cut down your spend and avoid going into the red.

- Explore your options – just because you’re out of work doesn’t mean you have no available options. How you approach budgeting will very much depend on your personal circumstances, but there’s no need to panic if you do find that your income isn’t covering the essentials. If your work situation is temporary, you might consider requesting payment holidays or looking at any benefits you may be entitled to until you can get back on your feet, whereas longer-term unemployment might prompt you to look for part-time and full-time work or even taking in a lodger into your home to generate some additional money.

How to stop spending money

Cutting out non-essential spending completely might sound like the simplest way to reach financial stability, but it can be a lot harder to achieve in practice. How you approach cutting down on spending will depend on your financial and personal circumstances, but there are common themes across savers and budgeters of all kinds.

For some people, stopping spending might require you to physically remove the temptation – by which we mean cancelling your pre-arranged overdraft or hiding away your credit cards. With easy to access credit, running up debt can be all too easy and as you make repayments you might find yourself turning to credit time and time again. This is known as the ‘spiral of debt’, and it can leave you financially unstable and far from meeting your budgeting goals.

An approach taken by some budgeters is to work out the time cost of making a big or non-essential purchase so they can weigh up whether it’s worth it. To do this, you’ll need to know how much you earn hourly and apply that figure against what you want to buy. If you get paid just over minimum wage at £9 per hour, for example, a purchase for £200 would leave you having to work 22 hours to make back what you’ve spent (not including any tax liabilities that factor into your hourly wage).

There are many things that you can do to limit your spending and stay on budget, but it’s important to find an approach that works for you and leaves you comfortable. Overstretching yourself and cutting back entirely could leave you miserable and less likely to stick to your plan for long enough to reach your goals.

See more of our guides on Credit Action and see how you can improve your financial wellbeing.