Whether you’re in a new relationship or have been with your partner for many years, coming to an agreement on how to manage money can be tough. Unfortunately, the truth of the matter is that there is no single approach that will work in every relationship. Just because there isn’t a winning formula doesn’t mean that there aren’t things you can do to make life easier, however.

Money troubles are amongst the UK’s top reasons for relationship breakdown, with research showing that 21% of couples blame their money problems on their partner*. It’s no wonder that financial issues are the common most reason for divorce, and few people would deny that financial topics can be awkward to discuss with both loved ones and professionals alike.

In this guide we take a look at some of the most common problems that affect couples managing their money together, along with some ideas about ways of dealing with your joint finances constructively.

How to talk to your partner about money?

Much like other aspects of a relationship, managing money with your partner is all about finding the right balance. Making decisions about how to handle money is one of the most important steps you can take – especially if you are moving in together, getting married or thinking about having children.

Whether you decide that it’s best to keep your finances separate or that you want to go all in with joint accounts, the starting point is having an open and honest conversation that not only sets out your individual financial positions but also your goals and expectations.

If you open a joint bank account, for example, you will both be responsible for any overdrafts or debts that accrue and so creating trust from the outset is crucial. One of the reasons that so many couples argue about financial problems is that they feel they are being treated unfairly, or that they are contributing more than their partner to the shared pot.

What’s fair varies from relationship to relationship and being ‘reasonable’ doesn’t necessarily mean both parties putting the same amount into a joint account each month. The only way to work out the best path forward for you is for both partners to communicate well and make decisions based on the facts – such as how much each person earns, what outgoings each of you have and whether there are any financial goals that you want to work towards.

What financial options do couples have?

Just as there are a huge number of options available when deciding how to manage your own finances, the choice available to couples is almost endless. Although there are many ways in which you can break down the way that you can deal with money in a relationship, some of the most common options include:

- keeping separate accounts and paying your own way.

- sharing some costs and responsibilities but keeping others separate.

- sharing and managing everything jointly.

- the main earner (or ‘breadwinner’) paying their partner a regular allowance.

To give couples of a better idea of the options available, we’ve set out more information about each below – but it is important to remember that managing your money successfully is not as simple as choosing one route and sticking with it. Whether any one option works for your relationship will depend on your individual circumstances, and different approaches and combinations are always possible.

Keeping your money separate and paying your own way

Keeping a level of financial independence is incredibly important to some people, particularly if they are only in the early days of a relationship. Without opening a joint account, both partners will keep their income separate and need to keep up a good level of communication to ensure that all shared outgoings are managed in a way that both parties think is fair.

Shared bills will still need to be paid, and without a joint account to draw the money from many couples find that it is easier to split the costs on a case-by-case basis. With this in mind, it is also important to have clear plan about how shared costs will be paid – whether that means one person transferring their share to the other’s account or each taking responsibility for certain bills.

If you and your partner want to maintain a level of financial independence from one another, keeping your money separately could be the answer. This doesn’t mean, however, that you don’t need to communicate about your finances and keeping an open dialogue about spending decisions and individual responsibilities is critical to making a success of this approach.

Sharing some responsibilities but keeping others separate

Compromise can be key when it comes to successfully managing money whilst in a relationship. Many couples worry about committing themselves to sharing their money, and it can be helpful to remember that you don’t have to make a choice that completely ties you to one approach or another.

Opening a joint account to deal with shared expenses can help you to take responsibility for mutual costs whilst making sure that you can both maintain a level of financial independence. One of the easiest ways to approach paying into a joint account for bills is to come up with a mutual budget that covers off how much you both need to contribute towards these costs but doesn’t dictate how you spend the money that remains in your own account.

Working in this way doesn’t necessarily mean that both partners needs to pay the same amount into the joint account each month either – although this is something you could agree upon. By settling upon a contribution that you both feel is fair, you can avoid arguments and make your expectations clear from the very start.

Sharing everything jointly

It’s also possible to take things a step further and combine your finances entirely by using a joint account to pay for all of your outgoings from priority bills such as rent, mortgage and debt repayments through to smaller one-off purchases.

Some people find that it is easier to create and stick to a budget if all of their money is kept in the same pot – but it remains important to communicate effectively and set clear expectations to keep both partners satisfied.

If you do decide to combine forces and pay all of your regular income into an account that is used to pay for your outgoings, setting rules is the key to avoiding arguments. Before you open that all-encompassing joint account, you’ll need to be sure that you both have a good understanding of your financial position and what counts as an acceptable expenditure. Some couples find it useful to set a spending threshold at this stage too – which means that if you want to pay for something more expensive than the threshold from the joint account, you’ll both need to agree.

The main earner pays an allowance to their partner

For some couples, one of the biggest issues to overcome is the fact that one partner earns more than the other. Whilst there is no easy solution to any arguments that arise out of the earnings gap, there are financial solutions that can help to deal with the practical side of things.

If one partner is not earning, or is earning less than the other, it might make sense for you to keep your separate bank accounts and for the main earner (sometimes called the ‘breadwinner’) to pay their partner an allowance in regular instalments.

As with any other option, building up a level of trust via effective communication is key to making an allowance arrangement work. You will both need to decide how the money should be used – for instance whether the allowance is for household bills and spending money, or simply for personal costs. It’s also important for both partners to feel comfortable with the arrangement, and not as if the allowance is a ‘favour’ as approaching it in this way can lead to resentment. Even if one partner is not earning, it may be the case that they are contributing to the relationship in other ways that are just as valuable and important – for instance if they are a carer for a family member or taking on the role of raising children.

How do joint accounts work?

Although it is entirely possible for a couple to maintain their own separate bank accounts and still pay towards mutual costs, joint bank accounts are a common feature of life in a relationship. Despite having a number of slightly different features, a joint bank account works in much the same way as an ordinary current account – simply held in the names of two or more people who can use it.

You can apply for a joint account in the same way as you would to open your own personal bank account, although note that each of the proposed account holders will need to provide the relevant documentation including ID. Some high street banks will only allow you to open a joint account with one other person, but some let you have four or more people as named account holders, meaning that joint accounts can be effective money management tools for families as well as couples.

When you set up a joint bank account, you will need to make a decision about how the money held within it can be spent. This is known as a mandate, which sets out who has the authority to run the account and spend the money within it. When making this decision, you can decide upon:

- an either to sign mandate – where any of the named account holders can make changes to the account or spend the money held within it; or

- a both to sign mandate – where all named account holders must give their permission for any changes to be made to the account and for any spending or withdrawals.

As with individual current accounts, the money held in a joint bank account is protected by the Financial Services Compensation Scheme. This means that if your banking provider were to go bust or face difficulties, your money is protected up to £85,000 per person named on the joint account.

Do joint accounts affect your credit score?

The simple answer to this is yes – if you or your partner have a poor credit history, opening a joint account could leave the other with a lower credit rating. Once a joint account is opened, a ‘financial association’ between the named account holders will be created. This means that you will each be co-scored and your credit ratings will be linked.

After this point, one partner’s poor credit score could influence the other’s which would not otherwise happen in cases where partners just live together – even if they are married.

Pros and Cons of Joint Bank Accounts

As we’ve discussed above, there are lots of things to consider when making decisions about how to manage your money as a couple. Opening a joint account together is a big step and not one that should be taken lightly, not least because doing so creates a financial association between the account holders.

When considering how to keep your money, you may wish to consider some of the following advantages and disadvantages of opening a joint account:

Pros of joint accounts

- Money held in the account can be used to pay joint bills easily

- Both partners can monitor the account and make changes, deposits or withdrawals

- Partners can keep their joint and personal spending separate to help with budgeting

Cons of joint accounts

- A joint overdraft could leave you in debt if either of you spend too much, and the money could even be taken directly from your personal current account if it’s held with the same bank

- Opening a joint account creates a financial association between you and the other account holders, so your credit record could be damaged if your partner has a poor credit history

- It could be difficult to deal with the contents of a joint account if you fall out or split up, particularly if you have chosen a both sign mandate.

How do joint debts work?

Shared debts are the flipside of joint finances and can come in many different forms. A joint debt is created when you borrow money or enter into a financial agreement alongside somebody else – for instance, a jointly held loan or credit agreement for a large purchase.

Whilst many people believe that shared debts are split equally between the account holders, this is not strictly true. When you take out a joint debt, both parties become responsible for the whole amount – not just their own share. If one partner is unable to pay, you will both be liable for the full debt no matter which of you actually spent the money. The legal term for this is ‘joint and several liability’.

Joint and several liability can apply to many varieties of debt, but some of the more common ones include jointly held personal loans, household bills, rent and mortgage arrears and council tax payments.

Can you take out a joint credit card?

On the topic of joint debts, it is worth mentioning a common misconception about credit cards. Although it is widely assumed that credit card debt can be held in joint names, this is not the case as joint credit cards are not available in the UK.

Here, credit card agreements can only be taken out in the name of a single primary cardholder – who is responsible for repaying the debt in full even if the money was spent by an additional authorised cardholder.

With this in mind, some people may it find it useful to set expectations, limits and rules for using a credit card before making their partner an additional authorised cardholder. Taking this approach could help to prevent any arguments about its use from arising in the future.

Couple’s Credit Ratings

As mentioned elsewhere in this guide, taking out a joint credit agreement or another form of debt with your partner could lead to their financial history influencing your credit rating. This is because your joint credit agreement will create a financial association between you, which to some extent will link your credit scores together.

This is an important factor to consider when deciding whether to merge your credit accounts with your partner. Whilst doing so could make it easier to manage your finances, it is worth remembering the following:

- both partners will be responsible for the whole debt on any joint credit accounts;

- no matter who incurred the debt, any missed payments on a joint account will negatively affect the credit files of both partners; and

- if either partner misses a payment on their individual account, your ability to take out joint credit in future may be limited.

Does getting married affect your credit score?

Getting married itself will not impact your credit score – but many of the financial practices that married couples engage in are more likely to do so. Seeking credit in joint names – for example if you apply for a car loan or mortgage – could have an affect on the future credit rating and ability to borrow of both partners.

It is also important to remember that when taking out credit jointly with your spouse, both of your financial histories will come under examination. Even if one partner has an excellent credit score, a history of poor money management from the other partner could lead to credit being issued with a higher rate of interest or even additional fees than if the partner with the higher credit rating had applied alone.

Soon to be wed couples should also be careful not to underestimate the amount of paperwork that must be completed post-marriage. When changing your name to that of your spouse, you will often need to make contact with multiple organisations (including all that you bank with) and provide identification to confirm the change.

If you miss a provider off or fail to update you name on the electoral role, your credit rating could be affected and you may even find yourself losing any credit history that was built up in your old name. If this does happen, it may be necessary to make contact with all of the UK’s major credit reference agencies yourself to link your names and financial records – which could require substantial effort on your part.

How to create a budget with your partner

Creating a budget is one of the most proactive things you can do to improve your financial situation. With a realistic budget that takes account of your income and expenditures, you can start to save and can cut out any unnecessary costs that you might otherwise not even realise you had. This applies as much to couples as it does to individuals, and financial planning is an important part of preventing you falling into joint debt.

There’s no one way to make a budget that works, but looking at the income and expenses of both partners is a good place to start. This will enable you to work out how much you are spending and if you need to bring that amount down to reach your financial goals – for instance saving a certain amount each month to put towards purchasing a home together. Using this as a framework, you can then begin to work out how much you can afford to spend on various things throughout the month. Some people find it useful to divide types of expenditure into categories, for instance:

- food and groceries

- entertainment and dining out

- sports and leisure activities

- clothes and personal items

- routine payments (such as for car maintenance and prescription medication)

Once you’ve agreed a budget with your partner, the hard work of sticking to it begins. This will mean keeping with the spending limits set at the start, and adjusting your budget as time goes on to reflect changes to your situation, income or expenses.

Tracking your budget is just as important as setting it, and being realistic about what you earn, spend and can afford to save is key to staying on track. You could keep tabs on your finances by creating a joint spreadsheet, or even by singing up to one of the many finance tracker tools that help to breakdown your spending in categories.

For more information about these, see our guide to money management apps below.

Building a fund for life’s little emergencies

A frequently overlooked aspect of budgeting is making sure you have enough money set aside to be used when you really need it. A rainy day fund can be incredibly helpful when you’re unexpectedly faced with an expensive bill or have to face a difficult situation – whether you lose your job, have to deal with illness or need to pay for major home or vehicle repairs.

There are plenty of debt advisory blogs out there that suggest saving up around 6 months’ worth of household expenses as an emergency fund, but this just isn’t achievable for everyone. In truth, any amount can be helpful so putting aside as much as you can afford is a step in the right direction.

Having financial security, whether you are in a relationship or not, can help to tackle money worries and all of the arguments and angst that go with them.

Thinking to the future – Savings, Costs and Pensions

Saving for the future is an important consideration for anybody, whether they are in a relationship or not. The sooner you start thinking about saving or getting a pension, the sooner you can start to build a financially stable future for yourself and your partner. Knowing where you will both stand financially when the time comes to retire could also help you to set a budget that works for your situation – both now and when that time comes.

Pensions are highly individual, and also a topic that requires thorough research to be understood. Despite this, it’s important for couples to consider what their pension pot looks like at a relatively early stage as planning effectively as a duo could help to maximise the money you have to enjoy in later life. There is also a pension pay gap to take into account that, whilst unfair, persists between men and women. According to figures from the Independent Pensions Advisory Service, 33% of men expect to retire with income only from their state pension, compared to 53% of women. The figures are even more shocking when looking at pension savings pots, where the average UK man holds £73,600, compared to only £24,900 for the average woman.

Whilst pensions are a complex topic, there are a few things that couples might consider doing to give themselves the best chance of enjoying a future free from financial troubles:

Make the most of the personal tax allowance

All adults in the UK have a personal allowance, which effectively is the level of income that you can have before having to pay any tax. To take advantage of this allowance, couples may decide that both partners should have separate pensions to ensure that they can benefit from an allowance for each person.

Get involved in workplace pension schemes

Since April 2017, all UK employers are required to provide a workplace pension for eligible employees who do not opt out. By entering into a workplace pension scheme, you can benefit from the mandatory employer contribution which requires them to pay a percentage of your salary into your pension pot to ‘top up’ the funds that you are already saving.

Keep an eye on your national insurance credits

For those who reached the state pension age on or after 6 April 2016, it is no longer possible to increase your state pension based on your partner’s national insurance contributions because it is based on your own personal work record.

The full state pension is only available to individuals who have a complete record of contributions towards national insurance – which in other words means that you will need to have paid or received credits for national insurance for a period of 35 years. If you do not reach this threshold, you can make voluntary contributions to top up your qualifying years, but it’s worth keeping tabs on this figure to make sure that both you and your partner qualify for the maximum level of the state pension.

Getting technical – apps to help manage money in a relationship

Thanks to legal developments that deal with the way finance companies operate in the UK, there is now more choice than ever when it comes to digital tools, apps and widgets that could help you to manage your money. Open Banking means that the UK’s major banks are now required to provide third-parties with access to your financial data – provided that you agree to this. With this in mind, tech companies have created a whole host of useful tools that could help you to save your money and budget effectively just by analysing your financial data.

Although there are many apps and tools available, we’ve compiled a list of some that could help you and your partner to see eye-to-eye on money matters:

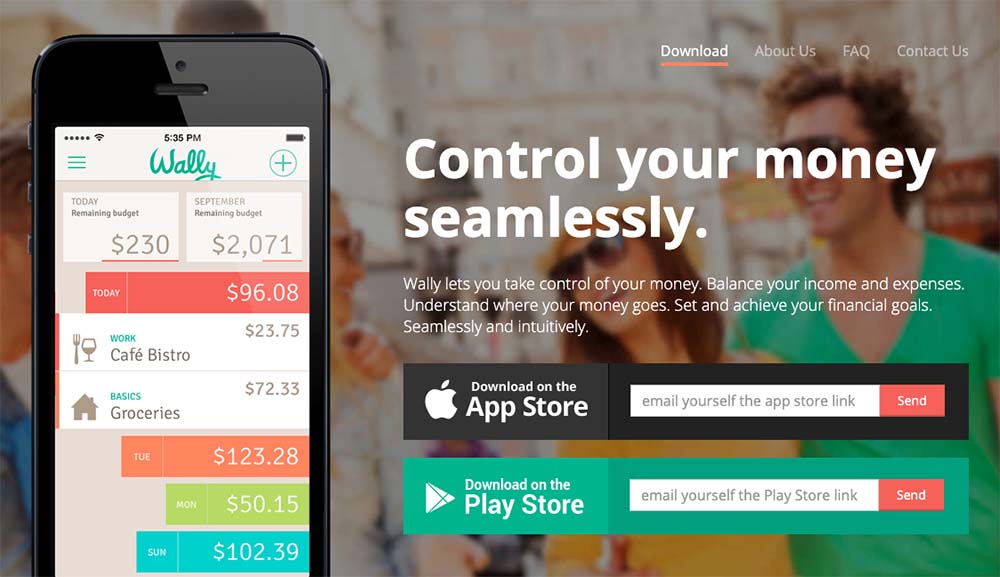

1. Wally

This free app has been made with those who don’t like the idea of giving their data away to a company. Wally simply asks you to input your financial data and then gets to work on calculating proposed daily or weekly budgets and saving targets. It can even give you spending insights when you’ve been knocking back extra coffees or buying a few more groceries than usual – allowing you to make informed decisions about spending.

Available on iOS & Android – Free

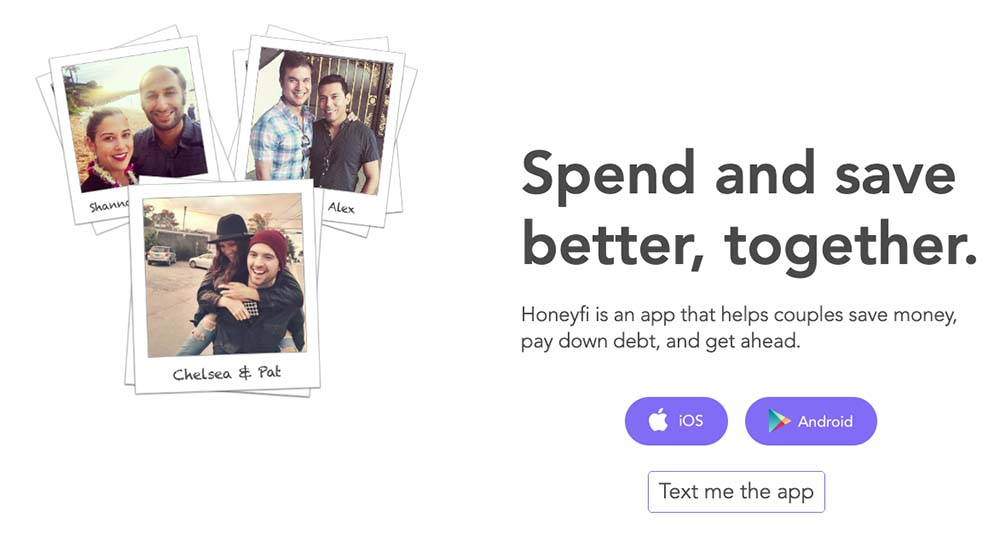

2. Honeyfi

Honeyfi provides couples with the tools they need to track their money. Just enter your bank account information and Honeyfi will get to work tracking your finances together – across banks and credit providers. By allowing both partners to get alerts whenever someone spends, this app provides the ultimate option for couples seeking accountability and could help you to work towards saving for a joint purchase.

Available on iOS & Android on a monthly or yearly plan

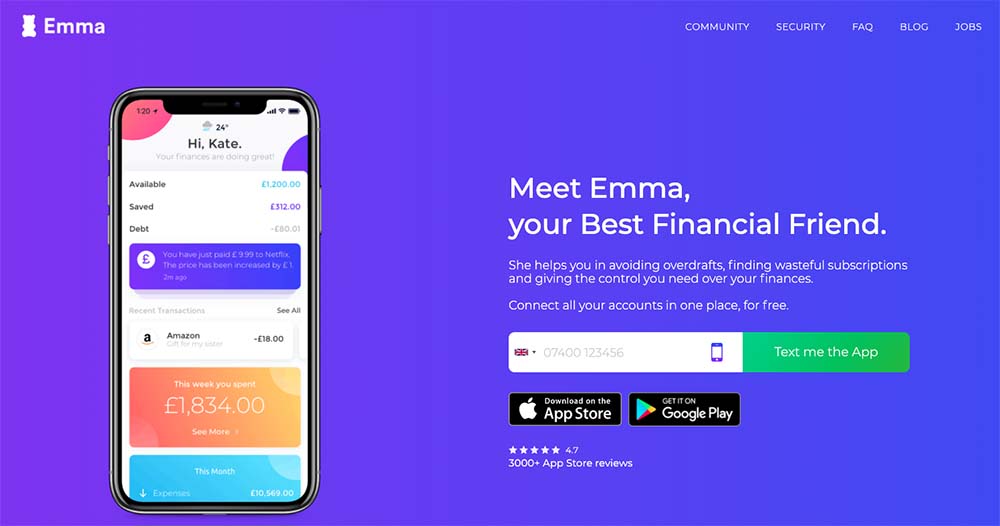

3. Emma

Stop wasting money on subscriptions you don’t need by using Emma to cancel them! By analysing your spending habits, Emma will calculate a savings target that you can realistically afford and will keep you on the straight and narrow by sending alerts whenever you get close to your budget limits. The app will also highlight fees that are above market rate – so you can begin to shop around for the best deals on the accounts that cost you the most.

Available on iOS & Android – Free

4. Honeydue: Couples Finance

Honeydue is a tracker with a difference that could help you and your partner to keep on top of bills and other shared expenses. By compiling data on your transactions and accounts, Honeydue can help you to develop a budget that has real insight into your spending habits. It also allows you to decide how much information you share with your significant other, so you can maintain a level of privacy that suits you.

Available on iOS & Android – Free

The bottom line

No matter how much money you have at your disposal, there’s no escaping the fact that managing it well and with the support of your partner can make it easier to deal with the administrative side of a relationship. Taking the right steps, at the right time can also prevent you from arguing with your partner about money – leaving you with more time to enjoy the many positive aspects of being in a relationship.

However you choose to approach managing money with your partner, it’s important to recognise the value of seeking qualified financial advice. Pensions, joint account arrangements and financial planning can be difficult topics to deal with and getting professional advice can help you to make informed decisions that work in your relationship. When it comes to managing money, there is no one-size-fits-all solution that is appropriate for everybody and only by taking stock of your options and getting help when needed can you find the best way forward. * According to a study conducted by UK law firm Slater & Gordon